Description

Are you interested in an updated edition? Then please indicate the desired publication date and content in the form. We look forward to responding to you promptly.

The Fillers Market Report – Europe is now also available in parts (e.g. individual country profiles or all manufacturer profiles). Please feel free to contact us and we will immediately send you an offer for your specific selection.

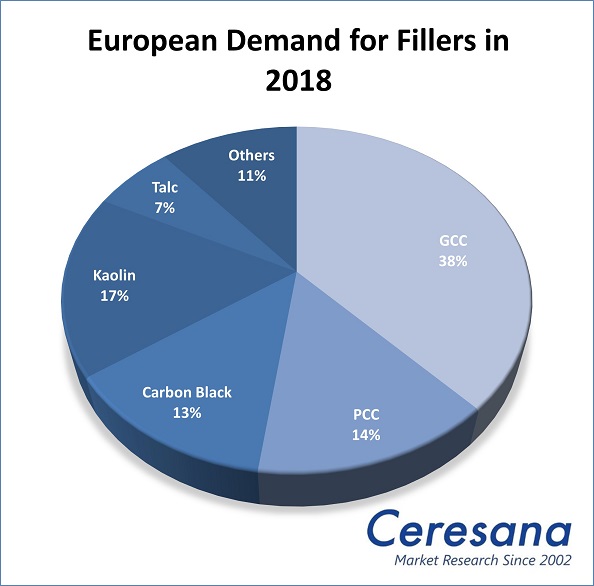

Fillers not only make many products cheaper, they often also improve their properties, such as stability, weather-resistance, and electrical conductivity, of numerous products. Ceresana has already analyzed the global market for these important materials several times. Now, the market research company publishes a report on the European fillers market for the first time: European demand for ground calcium carbonate (GCC), precipitated calcium carbonate (PCC), kaolin, talc, carbon black, and other fillers will presumably increase to about 18 million tonnes in 2026.

Elastomer Producers are Major Consumers

In the current filler report, the individual application areas are analyzed in detail. The most important applications for fillers are the production and processing of paper, plastics, paints and varnishes, elastomers as well as adhesives and sealants. The main use in Western and Eastern Europe is different: In Western Europe, most fillers are used in the paper industry, while in Eastern Europe, producers of elastomers account for the highest demand. In Europe, the elastomer industry was the major consumer in 2018 with a demand of about 4.3 billion tonnes.

Calcium Carbonate and Kaolin for Plastics and Paper

With a market share of about 38%, the most commonly used filler on the European market is ground calcium carbonate (GCC). In 2018, about 22% of total European demand for GCC were utilized in Germany.The largest consumer of GCC is the segment plastics, which is likely to increase its demand for fillers even further. The segment paper ranked second, followed by the segment adhesives and sealants. Until 2026, Ceresana forecasts an annual increase of GCC at rates of 1.3%.

The second largest fillers market is Kaolin with a total European demand of about 2.9 million tonnes. Germany is again the major consumer. The most important application area is the paper industry: Kaolin makes paper more opaque, whiter, and increases the bulk density. The filler also gives the paper a smoother surface as it fills the cavities between the fibers.

Precipitated Calcium Carbonate (PCC) is the third largest sales market. PCC has many properties that are similar to natural GCC, but offers, for example, a lower abrasive effect and a higher chemical purity. Various parameters of PCC can be adjusted to exact applications. PCC is mostly used for paper production, followed by paints and coatings.

Positive Forecasts

Market researchers at Ceresana expect a positive development for the European fillers market for the upcoming years. Until 2026, demand for fillers should increase by about 1.1% per year. Germany will presumably remain the most important sales market and the elastomer industry the most important application area for fillers in Europe.

The Study in Brief:

Chapter 1 provides a description and analysis of the European market for fillers – including forecasts up to 2026. For 22 European countries, demand in tonnes and revenues in euros are given. Furthermore, the European and country-specific demand per product type and application area is analyzed.

The following filler types are examined in detail:

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Carbon Black

- Kaolin

- Talc

- Other Fillers

Application areas analyzed in this study are:

- Paper

- Plastics

- Paints and Coatings

- Elastomers

- Adhesives and Sealants

Chapter 2 analyzes the 22 most important countries and their filler revenues and demand. Demand is split by individual applications and product types; the demand of the particular product type split by applications (e.g. demand of GCC in plastic in Belgium) is analyzed. Additionally, all important manufacturers of fillers are listed according to countries.

Chapter 3 provides useful profiles of the largest manufacturers of fillers, clearly arranged according to contact details, turnover, profit, product range, production sites, profile summary, and product types. In-depth profiles of 56 producers are given, including BASF SE, Calcit d.o.o., Carmeuse, S.A., Compagnie de Saint-Gobain S.A., HeidelbergCement Group, Imerys SA, LKAB Minerals AB, Nordkalk Corporation, Omya International AG, and Quarzwerke GmbH.

Scope of the Report:

Attributes | Details |

| Base Year | 2018 |

| Trend Period | 2010 – 2026 |

| Forecast Period | 2019 – 2026 |

| Pages | 290 |

| Filler Types | Ground Calcium Carbonate (GCC), Precipitated Calcium Carbonate (PCC), Carbon Black, Kaolin, Talc, Other Fillers |

| Application Areas | Paper, Plastics, Paints and Coatings, Elastomers, Adhesives and Sealants |

| Company Profiles | BASF SE, Calcit d.o.o., Carmeuse, S.A., Compagnie de Saint-Gobain S.A., HeidelbergCement Group, Imerys SA, LKAB Minerals AB, Nordkalk Corporation, Omya International AG, and Quarzwerke GmbH (Selection) |

| Edition | 1st edition |

| Publication | July 2019 |

FAQs

Which market volume will the market for fillers reach by 2026?

European demand for fillers will presumably increase to about 18 million tonnes in 2026.

What are the most important areas of application for fillers?

The most important applications for fillers are the production and processing of paper, plastics, paints and varnishes, elastomers as well as adhesives and sealants. However, there are differences between Western and Eastern Europe.

Which application area has the highest consumption of fillers?

In Europe, the elastomer industry was the major consumer of fillers in 2018 with a demand of about 4.3 billion tonnes.

Which filler type is most in demand in Europe?

With a market share of about 38%, the most commonly used filler on the European market is ground calcium carbonate (GCC).

1 Market Data

1.1 Europe

1.1.1 Demand

1.1.2 Revenues

1.1.3 Applications

1.1.3.1 Paper

1.1.3.2 Plastics

1.1.3.3 Paints and Varnishes

1.1.3.4 Elastomers

1.1.3.5 Adhesives and Sealants

1.1.3.6 Excursus: Paper – Coatings

1.1.4 Products

1.1.4.1 Ground Calcium Carbonate (GCC)

1.1.4.2 Precipitated Calcium Carbonate (PCC)

1.1.4.3 Carbon Black

1.1.4.4 Kaolin

1.1.4.5 Talc

1.1.4.6 Other Fillers

2 Market Data: Countries

2.1 Europe

2.1.1 Austria

2.1.2 Belgium

2.1.3 Czechia

2.1.4 Finland

2.1.5 France

2.1.6 Germany

2.1.7 Greece

2.1.8 Hungary

2.1.9 Italy

2.1.10 Poland

2.1.11 Portugal

2.1.12 Romania

2.1.13 Russia

2.1.14 Slovakia

2.1.15 Slovenia

2.1.16 Spain

2.1.17 Sweden

2.1.18 Switzerland

2.1.19 The Netherlands

2.1.20 Turkey

2.1.21 Ukraine

2.1.22 United Kingdom

2.1.23 Rest of Europe

3 Company Profiles*

3.1 Austria (5)

3.2 Belgium (4)

3.3 Czechia (1)

3.4 Finland (1)

3.5 France (4)

3.6 Germany (17)

3.7 Italy (2)

3.8 Luxembourg (1)

3.9 Portugal (1)

3.10 Russia (4)

3.11 Slovenia (1)

3.12 Spain (1)

3.13 Sweden (2)

3.14 Switzerland (1)

3.15 Turkey (5)

3.16 Ukraine (1)

3.17 United Kingdom (5)

*Note: The profiles are assigned to the country in which the company or holding is headquartered. Profiles also include JVs and subsidiaries.

Graph 1: European demand for fillers from 2010 to 2026

Graph 2: European revenues generated with fillers from 2010 to 2026 in million USD and million EUR

Graph 3: European demand for fillers from 2010 to 2026 – split by applications

Graph 4: European demand for GCC, PCC, and kaolin in paper coatings from 2010 to 2026 – split by product

Graph 5: European demand for fillers from 2010 to 2026 – split by products

Graph 6: Demand for fillers in Austria from 2010 to 2026

Graph 7: Demand for fillers in Belgium from 2010 to 2026

Graph 8: Demand for fillers in Czechia from 2010 to 2026

Graph 9: Demand for fillers in Finland from 2010 to 2026

Graph 10: Demand for fillers in France from 2010 to 2026

Graph 11: Demand for fillers in Germany from 2010 to 2026

Graph 12: Demand for fillers in Greece from 2010 to 2026

Graph 13: Demand for fillers in Hungary from 2010 to 2026

Graph 14: Demand for fillers in Italy from 2010 to 2026

Graph 15: Demand for fillers in Poland from 2010 to 2026

Graph 16: Demand for fillers in Portugal from 2010 to 2026

Graph 17: Demand for fillers in Romania from 2010 to 2026

Graph 18: Demand for fillers in Russia from 2010 to 2026

Graph 19: Demand for fillers in Slovakia from 2010 to 2026

Graph 20: Demand for fillers in Slovenia from 2010 to 2026

Graph 21: Demand for fillers in Spain from 2010 to 2026

Graph 22: Demand for fillers in Sweden from 2010 to 2026

Graph 23: Demand for fillers in Switzerland from 2010 to 2026

Graph 24: Demand for fillers in the Netherlands from 2010 to 2026

Graph 25: Demand for fillers in Turkey from 2010 to 2026

Graph 26: Demand for fillers in Ukraine from 2010 to 2026

Graph 27: Demand for fillers in the United Kingdom from 2010 to 2026

Graph 28: Demand for fillers in the remaining European countries from 2010 to 2026

Table 1: European demand for fillers from 2010 to 2026

Table 2: European revenues generated with fillers in million EUR from 2010 to 2026 – split by major countries

Table 3: European demand for fillers from 2010 to 2026 – split by applications

Table 4: European demand for fillers in the segment paper from 2010 to 2026 – split by major countries

Table 5: European demand for fillers in the segment plastics from 2010 to 2026 – split by major countries

Table 6: European demand for fillers in the segment paints and varnishes from 2010 to 2026 – split by major countries

Table 7: European demand for fillers in the segment elastomers from 2010 to 2026 – split by major countries

Table 8: European demand for fillers in other applications from 2010 to 2026 – split by major countries

Table 9: European demand for fillers from 2010 to 2026 – split by products

Table 10: European demand for GCC from 2010 to 2026 – split by major countries

Table 11: European demand for GCC from 2010 to 2026 – split by applications

Table 12: European demand for PCC from 2010 to 2026 – split by major countries

Table 13: European demand for PCC from 2010 to 2026 – split by applications

Table 14: European demand for carbon black from 2010 to 2026 – split by major countries

Table 15: European demand for carbon black from 2010 to 2026 – split by applications

Table 16: European demand for kaolin from 2010 to 2026 – split by major countries

Table 17: European demand for kaolin from 2010 to 2026 – split by applications

Table 18: European demand for talc from 2010 to 2026 – split by major countries

Table 19: European demand for talc from 2010 to 2026 – split by applications

Table 20: European demand for other products from 2010 to 2026 – split by countries

Table 21: European demand for other products from 2010 to 2026 – split by applications

Table 22: Revenues generated with fillers in Austria from 2010 to 2026 in million USD and million EUR

Table 23: Demand for fillers in Austria from 2010 to 2026 – split by applications

Table 24: Demand for fillers in Austria from 2010 to 2026 – split by types of fillers

Table 25: Demand for GCC in Austria from 2010 to 2026 – split by applications

Table 26: Demand for PCC in Austria from 2010 to 2026 – split by applications

Table 27: Demand for carbon black in Austria from 2010 to 2026 – split by applications

Table 28: Demand for kaolin in Austria from 2010 to 2026 – split by applications

Table 29: Demand for talc in Austria from 2010 to 2026 – split by applications

Table 30: Demand for other fillers in Austria from 2010 to 2026 – split by applications

Table 31: Important manufacturers of fillers in Austria

Table 32: Revenues generated with fillers in Belgium from 2010 to 2026 in million USD and million EUR

Table 33: Demand for fillers in Belgium from 2010 to 2026 – split by applications

Table 34: Demand for fillers in Belgium from 2010 to 2026 – split by types of fillers

Table 35: Demand for GCC in Belgium from 2010 to 2026 – split by applications

Table 36: Demand for PCC in Belgium from 2010 to 2026 – split by applications

Table 37: Demand for carbon black in Belgium from 2010 to 2026 – split by applications

Table 38: Demand for kaolin in Belgium from 2010 to 2026 – split by applications

Table 39: Demand for talc in Belgium from 2010 to 2026 – split by applications

Table 40: Demand for other fillers in Belgium from 2010 to 2026 – split by applications

Table 41: Important manufacturers of fillers in Belgium

Table 42: Revenues generated with fillers in Czechia from 2010 to 2026 in million USD and million EUR

Table 43: Demand for fillers in Czechia from 2010 to 2026 – split by applications

Table 44: Demand for fillers in Czechia from 2010 to 2026 – split by types of fillers

Table 45: Demand for GCC in Czechia from 2010 to 2026 – split by applications

Table 46: Demand for PCC in Czechia from 2010 to 2026 – split by applications

Table 47: Demand for carbon black in Czechia from 2010 to 2026 – split by applications

Table 48: Demand for kaolin in Czechia from 2010 to 2026 – split by applications

Table 49: Demand for talc in Czechia from 2010 to 2026 – split by applications

Table 50: Demand for other fillers in Czechia from 2010 to 2026 – split by applications

Table 51: Revenues generated with fillers in Finland from 2010 to 2026 in million USD and million EUR

Table 52: Demand for fillers in Finland from 2010 to 2026 – split by applications

Table 53: Demand for fillers in Finland from 2010 to 2026 – split by types of fillers

Table 54: Demand for GCC in Finland from 2010 to 2026 – split by applications

Table 55: Demand for PCC in Finland from 2010 to 2026 – split by applications

Table 56: Demand for carbon black in Finland from 2010 to 2026 – split by applications

Table 57: Demand for kaolin in Finland from 2010 to 2026 – split by applications

Table 58: Demand for talc in Finland from 2010 to 2026 – split by applications

Table 59: Demand for other fillers in Finland from 2008 to 2024 – split by applications

Table 60: Revenues generated with fillers in France from 2010 to 2026 in million USD and million EUR

Table 61: Demand for fillers in France from 2010 to 2026 – split by applications

Table 62: Demand for fillers in France from 2010 to 2026 – split by types of fillers

Table 63: Demand for GCC in France from 2010 to 2026 – split by applications

Table 64: Demand for PCC in France from 2010 to 2026 – split by applications

Table 65: Demand for carbon black in France from 2010 to 2026 – split by applications

Table 66: Demand for kaolin in France from 2010 to 2026 – split by applications

Table 67: Demand for talc in France from 2010 to 2026 – split by applications

Table 68: Demand for other fillers in France from 2010 to 2026 – split by applications

Table 69: Important manufacturers of fillers in France

Table 70: Revenues generated with fillers in Germany from 2010 to 2026 in million USD and million EUR

Table 71: Demand for fillers in Germany from 2010 to 2026 – split by applications

Table 72: Demand for fillers in Germany from 2010 to 2026 – split by types of fillers

Table 73: Demand for GCC in Germany from 2010 to 2026 – split by applications

Table 74: Demand for PCC in Germany from 2010 to 2026 – split by applications

Table 75: Demand for carbon black in Germany from 2010 to 2026 – split by applications

Table 76: Demand for kaolin in Germany from 2010 to 2026 – split by applications

Table 77: Demand for talc in Germany from 2010 to 2026 – split by applications

Table 78: Demand for other fillers in Germany from 2010 to 2026 – split by applications

Table 79: Important manufacturers of fillers in Germany

Table 80: Revenues generated with fillers in Greece from 2010 to 2026 in million USD and million EUR

Table 81: Demand for fillers in Greece from 2010 to 2026 – split by applications

Table 82: Demand for fillers in Greece from 2010 to 2026 – split by types of fillers

Table 83: Demand for GCC in Greece from 2010 to 2026 – split by applications

Table 84: Demand for PCC in Greece from 2010 to 2026 – split by applications

Table 85: Demand for carbon black in Greece from 2010 to 2026 – split by applications

Table 86: Demand for kaolin in Greece from 2010 to 2026 – split by applications

Table 87: Demand for talc in Greece from 2010 to 2026 – split by applications

Table 88: Demand for other fillers in Greece from 2010 to 2026 – split by applications

Table 89: Revenues generated with fillers in Hungary from 2010 to 2026 in million USD and million EUR

Table 90: Demand for fillers in Hungary from 2010 to 2026 – split by applications

Table 91: Demand for fillers in Hungary from 2010 to 2026 – split by types of fillers

Table 92: Demand for GCC in Hungary from 2010 to 2026 – split by applications

Table 93: Demand for PCC in Hungary from 2010 to 2026 – split by applications

Table 94: Demand for carbon black in Hungary from 2010 to 2026 – split by applications

Table 95: Demand for kaolin in Hungary from 2010 to 2026 – split by applications

Table 96: Demand for talc in Hungary from 2010 to 2026 – split by applications

Table 97: Demand for other fillers in Hungary from 2010 to 2026 – split by applications

Table 98: Revenues generated with fillers in Italy from 2010 to 2026 in million USD and million EUR

Table 99: Demand for fillers in Italy from 2010 to 2026 – split by applications

Table 100: Demand for fillers in Italy from 2010 to 2026 – split by types of fillers

Table 101: Demand for GCC in Italy from 2010 to 2026 – split by applications

Table 102: Demand for PCC in Italy from 2010 to 2026 – split by applications

Table 103: Demand for carbon black in Italy from 2010 to 2026 – split by applications

Table 104: Demand for kaolin in Italy from 2010 to 2026 – split by applications

Table 105: Demand for talc in Italy from 2010 to 2026 – split by applications

Table 106: Demand for other fillers in Italy from 2010 to 2026 – split by applications

Table 107: Revenues generated with fillers in Poland from 2010 to 2026 in million USD and million EUR

Table 108: Demand for fillers in Poland from 2010 to 2026 – split by applications

Table 109: Demand for fillers in Poland from 2010 to 2026 – split by types of fillers

Table 110: Demand for GCC in Poland from 2010 to 2026 – split by applications

Table 111: Demand for PCC in Poland from 2010 to 2026 – split by applications

Table 112: Demand for carbon black in Poland from 2010 to 2026 – split by applications

Table 113: Demand for kaolin in Poland from 2010 to 2026 – split by applications

Table 114: Demand for talc in Poland from 2010 to 2026 – split by applications

Table 115: Demand for other fillers in Poland from 2010 to 2026 – split by applications

Table 116: Revenues generated with fillers in Portugal from 2010 to 2026 in million USD and million EUR

Table 117: Demand for fillers in Portugal from 2010 to 2026 – split by applications

Table 118: Demand for fillers in Portugal from 2008 to 2024 – split by types of fillers

Table 119: Demand for GCC in Portugal from 2010 to 2026 – split by applications

Table 120: Demand for PCC in Portugal from 2010 to 2026 – split by applications

Table 121: Demand for carbon black in Portugal from 2010 to 2026 – split by applications

Table 122: Demand for kaolin in Portugal from 2010 to 2026 – split by applications

Table 123: Demand for talc in Portugal from 2010 to 2026 – split by applications

Table 124: Demand for other fillers in Portugal from 2010 to 2026 – split by applications

Table 125: Revenues generated with fillers in Romania from 2010 to 2026 in million USD and million EUR

Table 126: Demand for fillers in Romania from 2010 to 2026 – split by applications

Table 127: Demand for fillers in Romania from 2010 to 2026 – split by types of fillers

Table 128: Demand for GCC in Romania from 2010 to 2026 – split by applications

Table 129: Demand for PCC in Romania from 2010 to 2026 – split by applications

Table 130: Demand for carbon black in Romania from 2010 to 2026 – split by applications

Table 131: Demand for kaolin in Romania from 2010 to 2026 – split by applications

Table 132: Demand for talc in Romania from 2010 to 2026 – split by applications

Table 133: Demand for other fillers in Romania from 2010 to 2026 – split by applications

Table 134: Revenues generated with fillers in Russia from 2010 to 2026 in million USD and million EUR

Table 135: Demand for fillers in Russia from 2010 to 2026 – split by applications

Table 136: Demand for fillers in Russia from 2010 to 2026 – split by types of fillers

Table 137: Demand for GCC in Russia from 2010 to 2026 – split by applications

Table 138: Demand for PCC in Russia from 2010 to 2026 – split by applications

Table 139: Demand for carbon black in Russia from 2010 to 2026 – split by applications

Table 140: Demand for kaolin in Russia from 2010 to 2026 – split by applications

Table 141: Demand for talc in Russia from 2010 to 2026 – split by applications

Table 142: Demand for other fillers in Russia from 2010 to 2026 – split by applications

Table 143: Important manufacturers of fillers in Russia

Table 144: Revenues generated with fillers in Slovakia from 2010 to 2026 in million USD and million EUR

Table 145: Demand for fillers in Slovakia from 2010 to 2026 – split by applications

Table 146: Demand for fillers in Slovakia from 2010 to 2026 – split by types of fillers

Table 147: Demand for GCC in Slovakia from 2010 to 2026 – split by applications

Table 148: Demand for PCC in Slovakia from 2010 to 2026 – split by applications

Table 149: Demand for carbon black in Slovakia from 2010 to 2026 – split by applications

Table 150: Demand for kaolin in Slovakia from 2010 to 2026 – split by applications

Table 151: Demand for talc in Slovakia from 2010 to 2026 – split by applications

Table 152: Demand for other fillers in Slovakia from 2010 to 2026 – split by applications

Table 153: Revenues generated with fillers in Slovenia from 2010 to 2026 in million USD and million EUR

Table 154: Demand for fillers in Slovenia from 2010 to 2026 – split by applications

Table 155: Demand for fillers in Slovenia from 2010 to 2026 – split by types of fillers

Table 156: Demand for GCC in Slovenia from 2010 to 2026 – split by applications

Table 157: Demand for PCC in Slovenia from 2010 to 2026 – split by applications

Table 158: Demand for carbon black in Slovenia from 2010 to 2026 – split by applications

Table 159: Demand for kaolin in Slovenia from 2010 to 2026 – split by applications

Table 160: Demand for talc in Slovenia from 2010 to 2026 – split by applications

Table 161: Demand for other fillers in Slovenia from 2010 to 2026 – split by applications

Table 162: Revenues generated with fillers in Spain from 2010 to 2026 in million USD and million EUR

Table 163: Demand for fillers in Spain from 2010 to 2026 – split by applications

Table 164: Demand for fillers in Spain from 2010 to 2026 – split by types of fillers

Table 165: Demand for GCC in Spain from 2010 to 2026 – split by applications

Table 166: Demand for PCC in Spain from 2010 to 2026 – split by applications

Table 167: Demand for carbon black in Spain from 2010 to 2026 – split by applications

Table 168: Demand for kaolin in Spain from 2010 to 2026 – split by applications

Table 169: Demand for talc in Spain from 2010 to 2026 – split by applications

Table 170: Demand for other fillers in Spain from 2010 to 2026 – split by applications

Table 171: Revenues generated with fillers in Sweden from 2010 to 2026 in million USD and million EUR

Table 172: Demand for fillers in Sweden from 2010 to 2026 – split by applications

Table 173: Demand for fillers in Sweden from 2010 to 2026 – split by types of fillers

Table 174: Demand for GCC in Sweden from 2010 to 2026 – split by applications

Table 175: Demand for PCC in Sweden from 2010 to 2026 – split by applications

Table 176: Demand for carbon black in Sweden from 2010 to 2026 – split by applications

Table 177: Demand for kaolin in Sweden from 2010 to 2026 – split by applications

Table 178: Demand for talc in Sweden from 2010 to 2026 – split by applications

Table 179: Demand for other fillers in Sweden from 2010 to 2026 – split by applications

Table 180: Revenues generated with fillers in Switzerland from 2010 to 2026 in million USD and million EUR

Table 181: Demand for fillers in Switzerland from 2010 to 2026 – split by applications

Table 182: Demand for fillers in Switzerland from 2010 to 2026 – split by types of fillers

Table 183: Demand for GCC in Switzerland from 2010 to 2026 – split by applications

Table 184: Demand for PCC in Switzerland from 2010 to 2026 – split by applications

Table 185: Demand for carbon black in Switzerland from 2010 to 2026 – split by applications

Table 186: Demand for kaolin in Switzerland from 2010 to 2026 – split by applications

Table 187: Demand for talc in Switzerland from 2010 to 2026 – split by applications

Table 188: Demand for other fillers in Switzerland from 2010 to 2026 – split by applications

Table 189: Revenues generated with fillers in the Netherlands from 2010 to 2026 in million USD and million EUR

Table 190: Demand for fillers in the Netherlands from 2010 to 2026 – split by applications

Table 191: Demand for fillers in the Netherlands from 2010 to 2026 – split by types of fillers

Table 192: Demand for GCC in the Netherlands from 2010 to 2026 – split by applications

Table 193: Demand for PCC in the Netherlands from 2010 to 2026 – split by applications

Table 194: Demand for carbon black in the Netherlands from 2010 to 2026 – split by applications

Table 195: Demand for kaolin in the Netherlands from 2010 to 2026 – split by applications

Table 196: Demand for talc in the Netherlands from 2010 to 2026 – split by applications

Table 197: Demand for other fillers in the Netherlands from 2010 to 2026 – split by applications

Table 198: Revenues generated with fillers in Turkey from 2010 to 2026 in million USD and million EUR

Table 199: Demand for fillers in Turkey from 2010 to 2026 – split by applications

Table 200: Demand for fillers in Turkey from 2010 to 2026 – split by types of fillers

Table 201: Demand for GCC in Turkey from 2010 to 2026 – split by applications

Table 202: Demand for PCC in Turkey from 2010 to 2026 – split by applications

Table 203: Demand for carbon black in Turkey from 2010 to 2026 – split by applications

Table 204: Demand for kaolin in Turkey from 2010 to 2026 – split by applications

Table 205: Demand for talc in Turkey from 2010 to 2026 – split by applications

Table 206: Demand for other fillers in Turkey from 2010 to 2026 – split by applications

Table 207: Important manufacturers of fillers in Turkey

Table 208: Revenues generated with fillers in Ukraine from 2010 to 2026 in million USD and million EUR

Table 209: Demand for fillers in Ukraine from 2010 to 2026 – split by applications

Table 210: Demand for fillers in Ukraine from 2010 to 2026 – split by types of fillers

Table 211: Demand for GCC in Ukraine from 2010 to 2026 – split by applications

Table 212: Demand for PCC in Ukraine from 2010 to 2026 – split by applications

Table 213: Demand for carbon black in Ukraine from 2010 to 2026 – split by applications

Table 214: Demand for kaolin in Ukraine from 2010 to 2026 – split by applications

Table 215: Demand for talc in Ukraine from 2010 to 2026 – split by applications

Table 216: Demand for other fillers in Ukraine from 2010 to 2026 – split by applications

Table 217: Revenues generated with fillers in the United Kingdom from 2010 to 2026 in million USD and million EUR

Table 218: Demand for fillers in the United Kingdom from 2010 to 2026 – split by applications

Table 219: Demand for fillers in the United Kingdom from 2010 to 2026 – split by types of fillers

Table 220: Demand for GCC in the United Kingdom from 2010 to 2026 – split by applications

Table 221: Demand for PCC in the United Kingdom from 2010 to 2026 – split by applications

Table 222: Demand for carbon black in the United Kingdom from 2010 to 2026 – split by applications

Table 223: Demand for kaolin in the United Kingdom from 2010 to 2026 – split by applications

Table 224: Demand for talc in the United Kingdom from 2010 to 2026 – split by applications

Table 225: Demand for other fillers in the United Kingdom from 2010 to 2026 – split by applications

Table 226: Important manufacturers of fillers in the United Kingdom

Table 227: Revenues generated with fillers in the remaining European countries from 2010 to 2026 in million USD and million EUR

Table 228: Demand for fillers in the remaining European countries from 2010 to 2026 – split by applications

Table 229: Demand for fillers in remaining European countries from 2010 to 2026 – split by types of fillers

Table 230: Demand for GCC in the remaining European countries from 2010 to 2026 – split by applications

Table 231: Demand for PCC in the remaining European countries from 2010 to 2026 – split by applications

Table 232: Demand for carbon black in the remaining European countries from 2010 to 2026 – split by applications

Table 233: Demand for kaolin in the remaining European countries from 2010 to 2026 – split by applications

Table 234: Demand for talc in the remaining European countries from 2010 to 2026 – split by applications

Table 235: Demand for other fillers in the remaining European countries from 2010 to 2026 – split by applications