Description

Are you interested in an updated edition? Then please indicate the desired publication date and content in the form. We look forward to responding to you promptly.

The bioplastic films market report is now also available in parts (e.g. individual country profiles or all manufacturer profiles). Please feel free to contact us and we will immediately send you an offer for your specific selection.

Wafer-thin films, often less than 1 millimeter thick, are one of the first areas of application in which bioplastics are able to establish themselves. Although casings made from petroleum products are still usually sold cheaper and in larger quantities, biobased materials such as starch or polylactic acid do not only offer a better public image regarding environmental awareness, but often also tangible advantages: Food packaging made from biodegradable plastics does not have to be disposed of at high cost, but can be composted; organic mulch films can simply be left on the field and plowed under. Ceresana has studied the global market for films made from bioplastics: The new market report forecasts that revenues will increase to around USD 14.2 billion by 2032.

Increasing Demand for Biobased Films

If a film is supposed to crackle nicely, be transparent and permeable to water vapor, cellulose hydrate is hard to beat: The original bioplastic has been used since 1908 under names such as cellophane to package chocolates, flowers, spice jars or even cigarettes.For films made of polyethylene or polypropylene, biobased alternatives have long since ceased to be made only from wood or waste paper cellulose. Researchers are working on futuristic-looking bioplastics such as polyhydroxyalkanoate (PHA) from bacteria and polybutylene succinate (PBS) from fermentation residues. Increasingly, “biobased” components are also being added to conventional petrochemical plastics. Over the next ten years, the consumption of biobased films will increase significantly worldwide: Ceresana expects annual growth of over 14.6% in Asia, around 11% in North America and just over 8% in Europe.

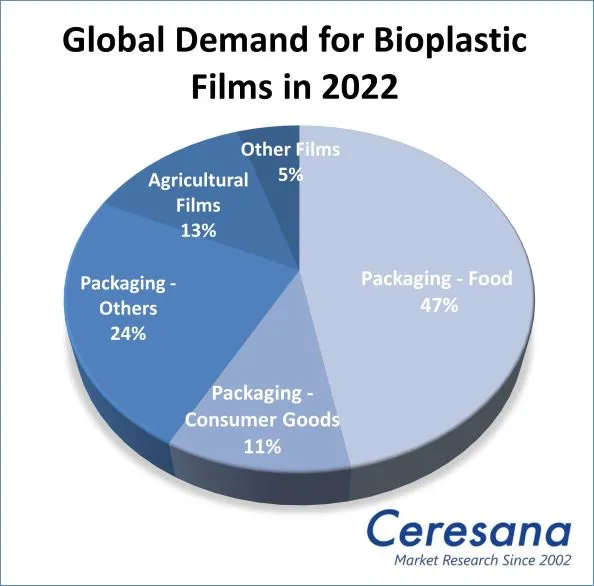

Biobased Films Mainly Package Food Products

Bags, pouches and sacks currently are the best-known application for bioplastics. Food packaging is the most important market for films made from bioplastics: In 2022, it accounted for around 47% of their market volume. However, shrink and stretch films are by no means only used in the packaging industry. Bioplastic films are also used, for example, for labels, adhesive tapes, technical insulating layers or medical wound dressings. In horticulture, forestry and agriculture, the consumption of films is increasing, as well as in the construction industry, the printing industry and other sectors of the economy. The analysts at Ceresana expect the highest annual growth rates of over 12% for agricultural films, industrial films and construction films. Increasingly, bioplastics are even conquering high-tech products: Membranes for water filters are made of polymer films, and plastic films are also used in batteries for electric cars.

The Current Ceresana Market Study “Bioplastic Films”:

Chapter 1 of the new study provides a comprehensive presentation and analysis of the global market for biobased plastic films – including forecasts up to 2032: The development of demand (tonnes) and revenues (USD and EUR) is presented for each of the regions of Europe, North America, Asia-Pacific and the rest of the world.

In Chapter 2, the 11 countries with the largest revenues generated with films are considered individually: Germany, France, the United Kingdom, Italy, the Netherlands, Spain, the USA, China, Japan, Taiwan and South Korea. Demand and revenues are presented in each case. In addition, demand is broken down by application area:

- Packaging – Food and Beverages

- Packaging – Consumer Products

- Packaging – Other

- Agricultural Films

- Other Films

The market study provides detailed data on the use of the different types of bioplastics in films:

- Polylactic acid (PLA)

- Starch-based plastics

- Other biodegradable plastics

- Biobased, but non-biodegradable plastics

Chapter 3 provides useful company profiles of the most important manufacturers of films made from bioplastics, clearly arranged by contact details, revenues, profit, product range, production facilities and brief profile. Detailed profiles are provided by 47 manufacturers, e.g. Bio Packaging Films, Cortec Corporation, Folietec Kunststoffwerk AG, Futamura Chemical Co., Ltd., Hubei HYF Packaging Co., Ltd., Kuraray Co., Ltd., and Stermitz Verpackungen GmbH.

Scope of the Report:

Attributes | Details |

Base Year | 2022 |

Trend Period | 2020 – 2032 |

Forecast Period | 2023 – 2032 |

Pages | 180 |

Application Areas | Packaging – Food and Beverages, Packaging – Consumer Products, Packaging – Other, Agricultural films, Other films |

Bioplastic Types | Polylactic Acid (PLA), Starch-Based Plastics, Other Biodegradable Plastics, Biobased but Non-Biodegradable Plastics |

Company Profiles | BASF, Braskem, FENC, NatureWorks, Novamont, Rodenburg, Teijin, Total Corbion, and Vegeplast (Selection) |

Edition | 1st edition |

Publication | July 2023 |

FAQs

How will the revenues generated with bioplastic films develop until 2032?

The new market report forecasts that revenues will increase to around USD 14.2 billion by 2032.

How will the demand for bioplastic films develop in the different regions?

Ceresana expects annual growth of over 14.6% in Asia, around 11% in North America and just over 8% in Europe.

What is the most important single market for bioplastic films?

Food packaging is the most important market for films made from bioplastics: In 2022, it accounted for around 47% of their market volume.

1 Market Data: World and Regions

1.1 World

1.1.1 Basics

1.1.2 Demand

1.1.3 Revenues

1.1.4 Demand Split by Application Area

1.1.5 Demand Split by Product

1.2 Europe

1.2.1 Demand

1.2.2 Revenues

1.2.3 Applications and Products

1.3 North America

1.3.1 Demand

1.3.2 Revenues

1.3.3 Applications and Products

1.4 Asia-Pacific

1.4.1 Demand

1.4.2 Revenues

14.3 Applications and Products

1.5 Rest of the World

1.5.1 Demand

1.5.2 Revenues

1.5.3 Applications and Products

2 Market Data: Countries

2.1 Europe

2.1.1 France

2.1.2 Germany

2.1.3 Italy

2.1.4 Spain

2.1.5 The Netherlands

2.1.6 United Kingdom

2.1.7 Rest of Europe

2.2 North America

2.2.1 Canada & Mexico

2.2.2 USA

2.3 Asia-Pacific

2.3.1 China

2.3.2 Japan

2.3.3 South Korea

2.3.4 Taiwan

2.3.5 Other Asia-Pacific

3 Company Profiles

3.1 Europe

Austria (2)

Germany (10)

Ireland (1)

Italy (4)

Norway (1)

Switzerland (1)

United Kingdom (2)

Slovenia (1)

3.2 North America

Canada (2)

USA (6)

3.3 Asia-Pacific

China (7)

India (1)

Japan (3)

South Korea (1)

Taiwan (3)

Thailand (1)

3.4 Middle East

United Arab Emirates (1)

Graph 1: Global demand from 2020 to 2032

Graph 2: Global demand from 2020 to 2032 – split by region

Graph 3: Global revenues from 2020 to 2032 in billion USD and billion EUR

Graph 4: Global revenues from 2020 to 2032 in billion USD – split by region

Graph 5: Global revenues from 2020 to 2032 in billion EUR – split by region

Graph 6: Global demand from 2020 to 2032 – split by application

Graph 7: Global demand in the application area of Packaging – Food and beverages from 2020 to 2032 – split by region

Graph 8: Global demand in the application area of Packaging – Consumer products from 2020 to 2032 – split by region

Graph 9: Global demand in the application area of Packaging – Other from 2020 to 2032 – split by region

Graph 10: Global demand in the application area of Agricultural Films from 2020 to 2032 – split by region

Graph 11: Global demand in the application area of Other Films from 2020 to 2032 – split by region

Graph 12: Global demand from 2020 to 2032 – split by product

Graph 13: Global demand for bioplastic films made of PLA from 2020 to 2032 – split by region

Graph 14: Global demand for bioplastic films made of starch-based plastics from 2020 to 2032 – split by region

Graph 15: Global demand for bioplastic films made of other biodegradable plastics from 2020 to 2032 – split by region

Graph 16: Global demand for bioplastic films made of non-biodegradable plastics from 2020 to 2032 – split by region

Graph 17: Demand in Europe from 2020 to 2032

Graph 18: Revenues generated in Europe from 2020 to 2032 in billion USD and billion EUR

Graph 19: Demand in Europe from 2020 to 2032 – split by application

Graph 20: Demand in North America from 2020 to 2032

Graph 21: Revenues generated in North America from 2020 to 2032 in billion USD and billion EUR

Graph 22: Demand in North America from 2020 to 2032 – split by application

Graph 23: Demand in Asia-Pacific from 2020 to 2032

Graph 24: Revenues generated in Asia-Pacific from 2020 to 2032 in billion USD and billion EUR

Graph 25: Demand in Asia-Pacific from 2020 to 2032 – split by application

Graph 26: Demand in the rest of the world from 2020 to 2032

Graph 27: Revenues generated in the rest of the world from 2020 to 2032 in billion USD and billion EUR

Graph 28: Demand in the rest of the world from 2020 to 2032 – split by application

Graph 29: Demand in France from 2020 to 2032

Graph 30: Demand in Germany from 2020 to 2032

Graph 31: Demand in Italy from 2020 to 2032

Graph 32: Demand in Spain from 2020 to 2032

Graph 33: Demand in the Netherlands from 2020 to 2032

Graph 34: Demand in the United Kingdom from 2020 to 2032

Graph 35: Demand in the remaining countries of Europe from 2020 to 2032

Graph 36: Demand in Canada & Mexico from 2020 to 2032

Graph 37: Demand in the USA from 2020 to 2032

Graph 38: Demand in China from 2020 to 2032

Graph 39: Demand in Japan from 2020 to 2032

Graph 40: Demand in South Korea from 2020 to 2032

Graph 41: Demand in Taiwan from 2020 to 2032

Graph 42: Demand in the remaining countries of Asia-Pacific from 2020 to 2032

Table 1: Global demand from 2020 to 2032 – split by region

Table 2: Global revenues from 2020 to 2032 in million USD – split by region

Table 3: Global revenues from 2020 to 2032 in million EUR – split by region

Table 4: Global demand from 2020 to 2032 – split by application

Table 5: Global demand in the application area of Packaging – Food and beverages from 2020 to 2032 – split by region

Table 6: Global demand in the application area of Packaging – Consumer products from 2020 to 2032 – split by region

Table 7: Global demand in the application area of Packaging – Other from 2020 to 2032 – split by region

Table 8: Global demand in the application area of Agricultural Films from 2020 to 2032 – split by region

Table 9: Global demand in the application area of Other Films from 2020 to 2032 – split by region

Table 10: Global demand from 2020 to 2032 – split by product

Table 11: Global demand for bioplastic films made of PLA from 2020 to 2032 – split by region

Table 12: Global demand for bioplastic films made of starch-based plastics from 2020 to 2032 – split by region

Table 13: Global demand for bioplastic films made of other biodegradable plastics from 2020 to 2032 – split by region

Table 14: Global demand for bioplastic films made of non-biodegradable plastics from 2020 to 2032 – split by region

Table 15: Demand in Europe from 2020 to 2032 – split by major country

Table 16: Revenues generated in Europe from 2020 to 2032 in million USD and million EUR

Table 17: Demand in Europe from 2020 to 2032 – split by application

Table 18: Demand in Europe from 2020 to 2032 – split by product

Table 19: Demand in North America from 2020 to 2032 – split by major country

Table 20: Revenues generated in North America from 2020 to 2032 in million USD and million EUR

Table 21: Demand in North America from 2020 to 2032 – split by application

Table 22: Demand in North America from 2020 to 2032 – split by product

Table 23: Demand in Asia-Pacific from 2020 to 2032 – split by major country

Table 24: Revenues generated in Asia-Pacific from 2020 to 2032 in million USD and million EUR

Table 25: Demand in Asia-Pacific from 2020 to 2032 – split by application

Table 26: Demand in Asia-Pacific from 2020 to 2032 – split by product

Table 27: Revenues generated in the rest of the world from 2020 to 2032 in million USD and million EUR

Table 28: Demand in the rest of the world from 2020 to 2032 – split by application

Table 29: Demand in the rest of the world from 2020 to 2032 – split by product

Table 30: Revenues generated in France from 2020 to 2032 in million USD and million EUR

Table 31: Demand in France from 2020 to 2032 – split by application

Table 32: Demand in France from 2020 to 2032 – split by product

Table 33: Revenues in Germany from 2020 to 2032 in million USD and million EUR

Table 34: Demand in Germany from 2020 to 2032 – split by application

Table 35: Demand in Germany from 2020 to 2032 – split by product

Table 36: Revenues generated in Italy from 2020 to 2032 in million USD and million EUR

Table 37: Demand in Italy from 2020 to 2032 – split by application

Table 38: Demand in Italy from 2020 to 2032 – split by product

Table 39: Revenues in Spain from 2020 to 2032 in million USD and million EUR

Table 40: Demand in Spain from 2020 to 2032 – split by application

Table 41: Demand in Spain from 2020 to 2032 – split by product

Table 42: Revenues generated in the Netherlands from 2020 to 2032 in million USD and million EUR

Table 43: Demand in the Netherlands from 2020 to 2032 – split by application

Table 44: Demand in the Netherlands from 2020 to 2032 – split by product

Table 45: Revenues in the United Kingdom from 2020 to 2032 in million USD and million EUR

Table 46: Demand in the United Kingdom from 2020 to 2032 – split by application

Table 47: Demand in the United Kingdom from 2020 to 2032 – split by product

Table 48: Revenues generated in the remaining countries of Europe from 2020 to 2032 in million USD and million EUR

Table 49: Demand in the remaining countries of Europe from 2020 to 2032 – split by application

Table 50: Demand in the remaining countries of Europe from 2020 to 2032 – split by product

Table 51: Revenues generated in Canada & Mexico from 2020 to 2032 in million USD and million EUR

Table 52: Demand in Canada & Mexico from 2020 to 2032 – split by application

Table 53: Demand in Canada & Mexico from 2020 to 2032 – split by product

Table 54: Revenues generated in the USA from 2020 to 2032 in million USD and million EUR

Table 55: Demand in the USA from 2020 to 2032 – split by application

Table 56: Demand in the USA from 2020 to 2032 – split by product

Table 57: Revenues generated in China from 2020 to 2032 in million USD and million EUR

Table 58: Demand in China from 2020 to 2032 – split by application

Table 59: Demand in China from 2020 to 2032 – split by product

Table 60: Revenues in Japan from 2020 to 2032 in million USD and million EUR

Table 61: Demand in Japan from 2020 to 2032 – split by application

Table 62: Demand in Japan from 2020 to 2032 – split by product

Table 63: Revenues generated in South Korea from 2020 to 2032 in million USD and million EUR

Table 64: Demand in South Korea from 2020 to 2032 – split by application

Table 65: Demand in South Korea from 2020 to 2032 – split by product

Table 66: Revenues generated in Taiwan from 2020 to 2032 in million USD and million EUR

Table 67: Demand in Taiwan from 2020 to 2032 – split by application

Table 68: Demand in Taiwan from 2020 to 2032 – split by product

Table 69: Revenues in the remaining countries of Asia-Pacific from 2020 to 2032 in million USD and million EUR

Table 70: Demand in the remaining countries of Asia-Pacific from 2020 to 2032 – split by application

Table 71: Demand in the remaining countries of Asia-Pacific from 2020 to 2032 – split by product